Expert Training for Data, Design & Product Teams

Pragmatic Institute is the transformational

partner for today’s businesses

TRENDING THIS WEEK

Get your spot in our featured courses

WORKSHOP

Advanced AI Techniques for Product Marketing

DATE

TIME

WORKSHOP

AI Training for

Product Professionals

Get the skills you need to streamline workflows and optimize product decision making through the use of generative AI and prompt engineering.

DATE

TIME

WORKSHOP

AI Training for

Product Professionals

Get the skills you need to streamline workflows and optimize product decision making through the use of generative AI and prompt engineering.

DATE

TIME

Foundations

4.9

Gain a thorough understanding of your market and the opportunities that drive results.

1,295.00

/ Online | On-Demand +Taxes

37k Active Alumni

Product Certification Badge (8 Courses)

The Gold Standard

Learning Paths That Lead to Success

At Pragmatic Institute, we don’t just do training—we provide proven methodologies, adaptable resources, battle-tested strategies and world-class support to organizations just like yours. In fact, thousands of companies around the world—from startups to Fortune 500—rely on our models to drive their business and power their strategies.We focus on building expertise and collaboration within and across product, data and design teams.

This allows organizations to accelerate innovation, grow revenue, improve customer satisfaction and drive success.

TRUSTED ALL OVER THE WORLD

What our students are saying

Practical, Actionable Education That Delivers Immediate Results

Product

Master the battle-tested tools and techniques needed to create and market truly great products. Tackle complex business problems with hands-on training that focuses on the product craft, from understanding your market to launching solutions that sell. Get the insights you need to:- Increase strategic focus

- Better understand roles and responsibilities

- Improve customer satisfaction

- Drive revenue

Data

Empower your data teams with actionable guidance, hands-on practice and a business-oriented approach so they can solve problems and propel decision making with data. Give your team the power to:- Translate business needs into strategic data projects

- Articulate value and impact to key stakeholders

- Master essential tools and programs

- Drive the future of data

Design

Equip your design team to connect human-centered work to business strategy. Extend the reach of design by uncovering new ways to add value. Give your team a seat at the table and the ability to:- Contribute more strategically

- Craft narratives around design

- Address user needs while advancing business goals

- Improve cross-functional collaboration

Training Options

No matter how you and your team learn, we’ve got the solution that’s right for you. Experience the best product and data training designed by the experts you trust.

Get certified in cities

all over the world.

The same great training,

no travel required.

Flexible training for

how you learn best.

In-person or live

online for your teams.

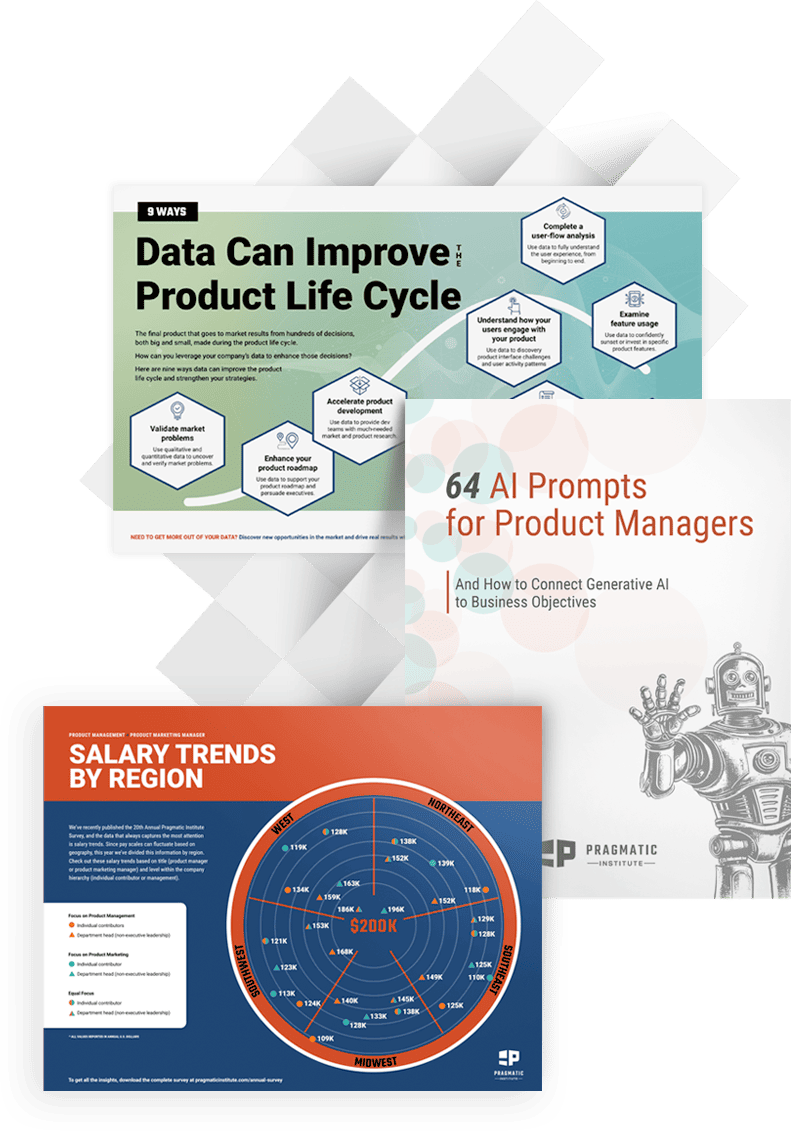

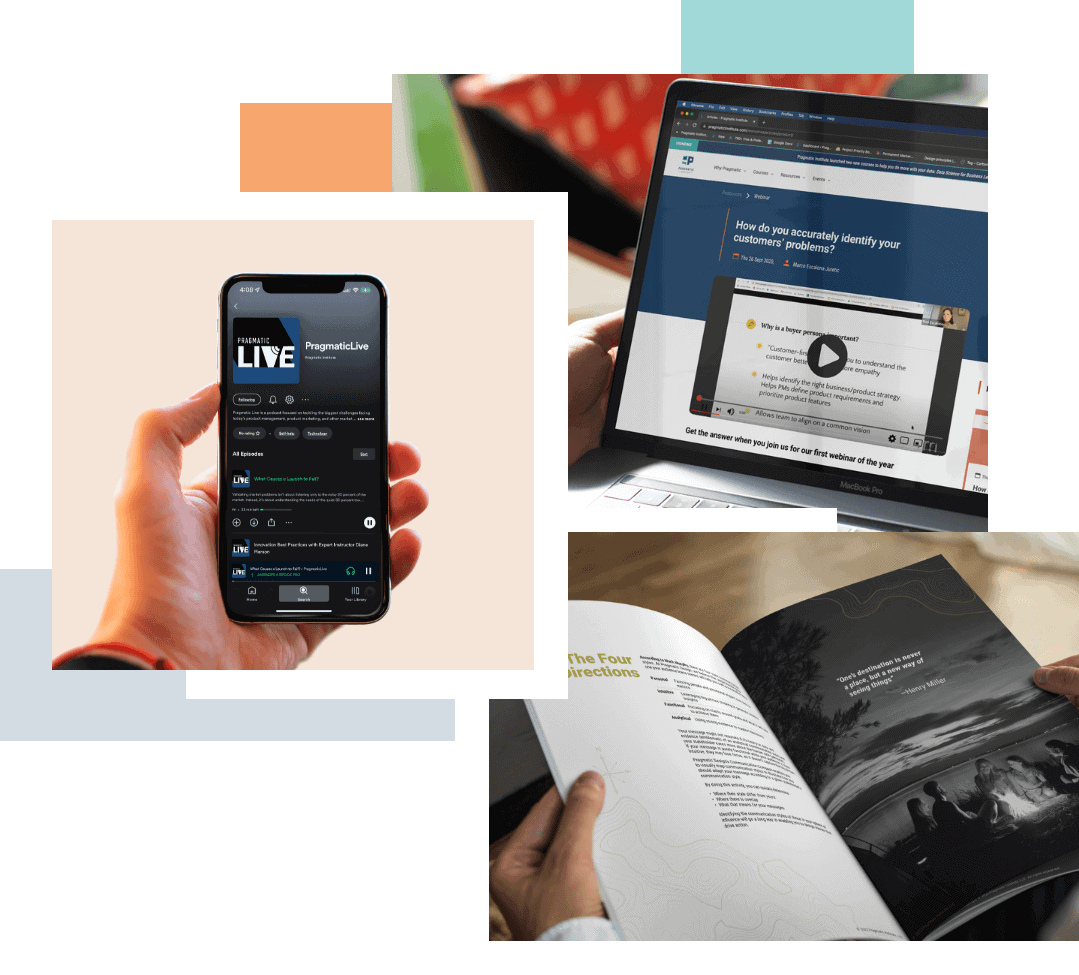

A Full Ecosystem of Resources

Learning doesn’t stop at the classroom door. That’s why we provide a wealth of articles, podcasts, ebooks, infographics, webinars and more on the latest and most important topics to keep you in-the-know.

And as a Pragmatic alum, you’ll be part of a worldwide community of like-minded data, design and product professionals: empowered with resources to solve problems; emboldened through conversation with peers who have been where you are; and engaged with continuous learning opportunities that will reinvigorate your passion for your role.

World-Class Certifications to Elevate Your Career

- Business-Driven Data Analysis

- Data Science for Business Leaders